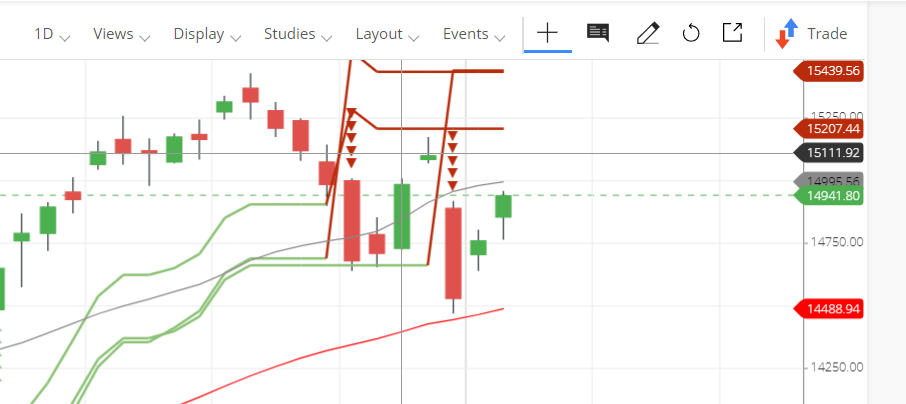

Markets shot up yesterday. It rallied in the last hour to close above 14900. As I told you, 20 and 50 DMA will be the range and a clear direction will emerge once either of these is broken. I am still bearish and I believe that markets will fall and break the support and there is less probability of a breakout. I will take aggressive short positions if the red line(50 DMA) is broken.

Yesterday, the spectrum auction has ended and jio is the highest buyer. Vodafone is now showing signs that it will survive. It is between 10-12 for a long time now. There is a high chance that it will break out of this range. I have an investment in this for the long term.

The midcaps are rallying. Just dial is now again back to news after it has entered B2B marketplace.

Yesterday the US markets closed in the red. Dow lost 0.5% and Nasdaq lost more than 1.5%

Bitcoin is now hovering around $50k. It looks like the heat in this is reducing. Is this consolidation before the next run or is it really losing investors interest?

As I told 32000 is a resistance for dow as well. We may not move higher as long os dow is below 32000.

MY TRADES

- I just did a some intraday trades yesterday and was able to make around 15000 profit.

- My positional trades are in good shape.

- If there is a gapup today, then I will short the market for intraday as I am bearish in the short term.

- I will buy puts in bnknifty and nifty if it opens in the green.

- Dow and nasdaq closed in the red.

- European markets closed in the red.

- Today the Asian markets are flat. SGX is suggesting a flat start.

- FII bought for 2000 cr and DII sold for 800cr in the cash markets.

- FII are mildly short in the FNO markets. So the markets may not rally more.

- Crude is trading at $62.83

- $ is at Rs 73

Comments

Post a Comment