It was expected that RBI would soon be forced to hike rates but no one expected it to be a surprise. Yesterday after the market opened, RBI told that there would be a press conference at 2 PM. Obviously, there was a lot of speculation and then Shaktikanta das came as a surprise and hiked the interest rate by 40 bps. Everyone expected it to happen in the next monetary policy but it happened suddenly with a surprise.

Another surprise was that the CRR was also hiked by 50 bps which markets did not like. Many intraday traders had to close their trades in losses as this was a surprise event. Luckily, I did not have any intraday trades. Not that I was intelligent, I did not have as all my margins were blocked in positional trades.

And as expected, the US Fed hiked the interest by 50bps. As I told you yesterday that this was factored into the market. Markets were waiting for the commentary from the fed chairman. Powell told that the fed would not hike rates aggressively from now. That was a positive booster for the markets and Dow shot 900 points. Even this move was almost expected. If there were any negative comments, then dow would have fallen 1000 points. Usually, the fed gives comments that favor the market and this time was no surprise.

Nifty fell close to 400 points led by banks, RIL, metals, and IT. Almost all sectors closed in the red. Frankly, the nifty movement is not giving a clear direction. One day it falls drastically and then it recovers the next day. For traders(me in particular), it is very difficult to take a directional call in the weekly expiry. A small position of my weekly trades is in danger which I feel can be managed today. Nowadays, I have reduced my exposure to weekly. It's mostly monthly and long-term.

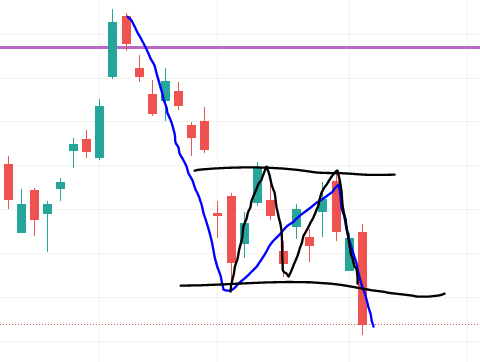

Seeing the charts, it looks like there has been a breakdown and we may head lower. Now 50and 200dma are strong resistances.

- I had positions where I had executed short strangle in nifty. Yesterday, the PE was in danger and I had to do a lot of adjustments. Today is expiry and I need to be slightly careful.

- Tomorrow is RIL result and I have taken the below trade in RIL

- Dow shot up 900 points and Nasdaq gained more than 3% yesterday after Powell gave some relief. Now dow futures are in slight red.

- Europe closed in the red.

- Today the Asian markets are in the green. SGX is suggesting a gap up of more than 150 points.

- FII sold for more than 3kcr

- DII bought for just 1300+cr

- Crude is now at $110. EU is planning to ban Russian oil gradually.

- $ is at Rs 76.5

Comments

Post a Comment